I am working on an innovative project: which study should I choose to ensure its potential?

Author: Syrine Cassagne

Webmarketing manager - Ixiade

STUDY | Reading time: 7 min

Chaque démarche d’innovation comporte son lot d’incertitudes et de risques, et le parcours d’innovation est généralement semé d’embûches, que vous soyez une start-up ou un grand groupe. Telles des boussoles, les études permettent d’orienter les prises de décision et de guider votre stratégie pour optimiser votre proposition de valeur. De plus, la partie relative aux études dans vos montages de projets et demandes de financements est celle qui va susciter le plus d’intérêt de la part de vos potentiels investisseurs et partenaires qui misent sur le succès de votre projet. Parfois négligées au détriment des spécifications techniques, les études sont néanmoins très demandées par les organismes publics ou privés tels que la Bpi ou les fonds d’investissement et sont décisives pour l’obtention de financements mais aussi pour la poursuite de votre projet.

Malgré le caractère connu et populaire de ce terme en marketing, le monde des « études » est plus obscur qu’il n’y paraît et il n’est pas toujours évident de s’y retrouver parmi tous les sens et méthodologies qui peuvent y être associés. C’est pourquoi, dans cet article, nous allons décortiquer pour vous les grandes familles d’études qui existent et vous donner des clés de compréhension pour vous guider vers l’approche la plus adaptée à vos besoins.

Market studies vs. usage studies

- PORTER's five forces which makes it possible to assess the competitive intensity of the market by distributing the power of negotiation between the various stakeholders such as customers, substitute products, new entrants and suppliers (some add a sixth force relating to the influence of the state).

- The competitive benchmark, which is relatively well known and unavoidable, makes it possible to identify the competitors, which is particularly interesting for determining one's marketing position, for example.

- PESTEL analysis (Political, Economic, Sociological, Technological, Ecological and Legal) to identify opportunities and threats in the company's macroeconomic and sectoral environment.

- SWOT analysis (FFOM in french) which classifies the opportunities and threats of the market as well as its own strengths and weaknesses in order to build virtuous combinations and identify key success factors.

- The assessment of acceptability, which allows to understand the ability of users to imagine themselves using the innovative solution by looking at four levels of analysis (adequacy of the innovation to the know-how, practices, identity and environment of the user)

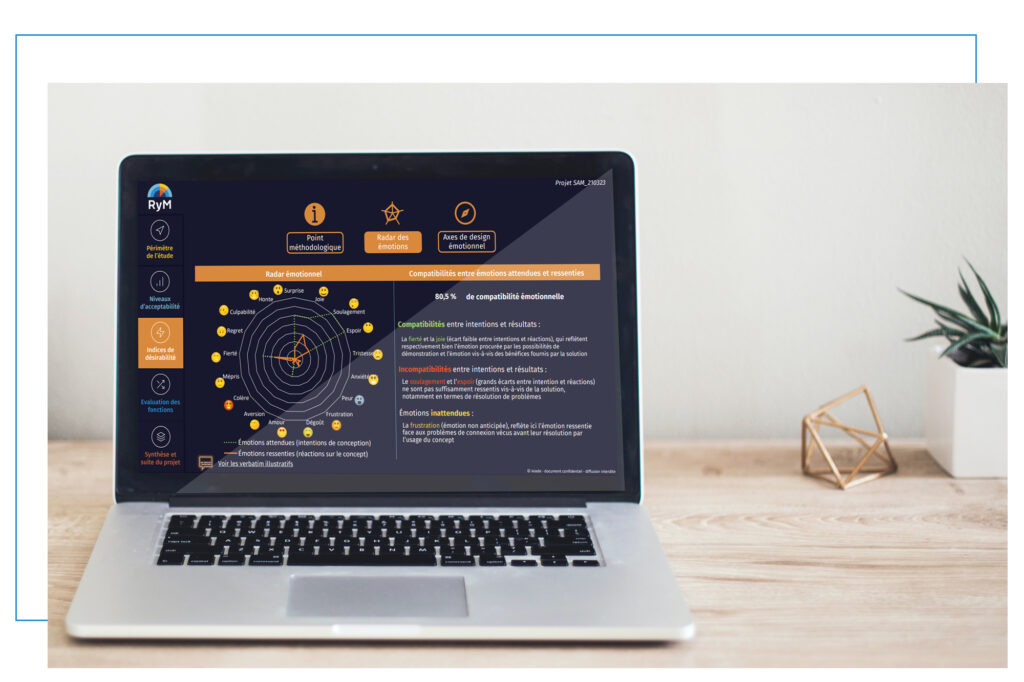

- The assessment of desirability, which allows to evaluate the emotional compatibility between innovation and users by comparing the expected emotions to those actually felt.

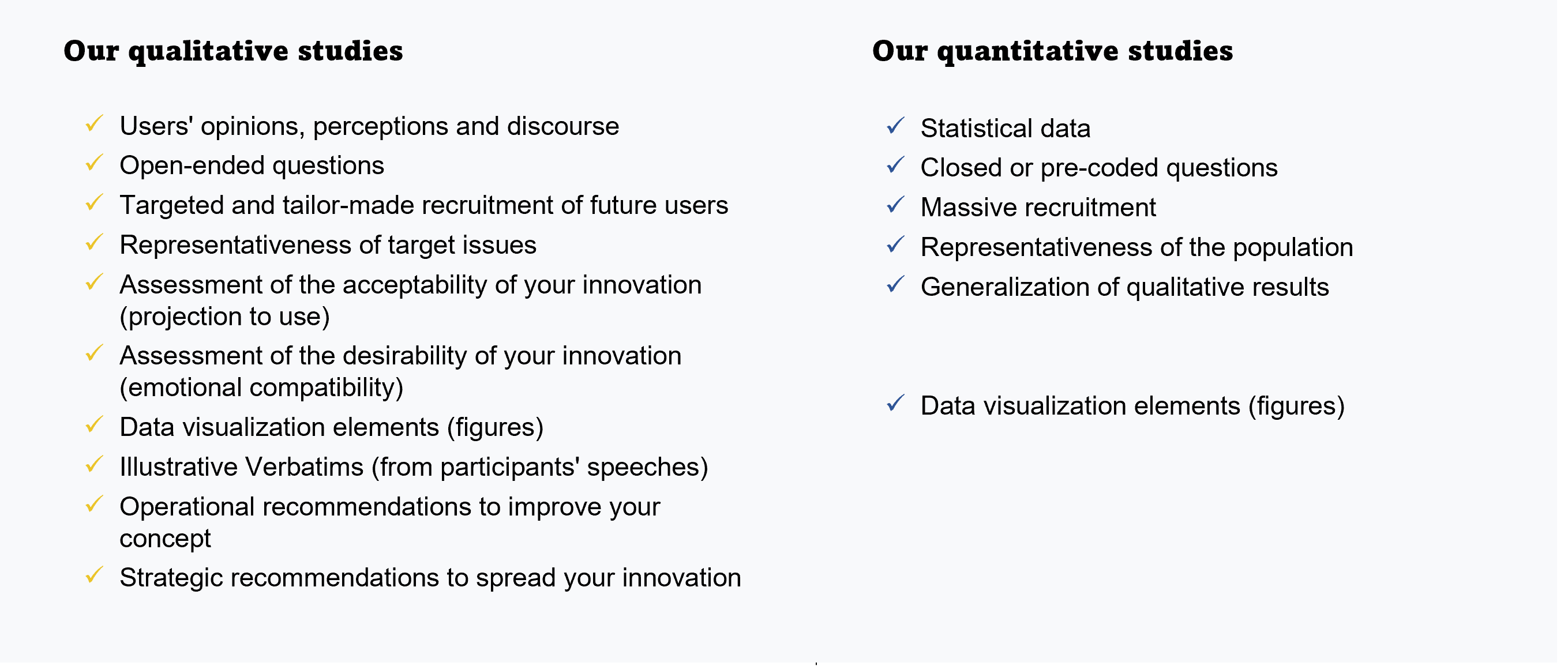

Qualitative studies vs. quantitative studies

Qualitative studies allow to obtain rich data on the opinions and perceptions of users, thanks to open-ended questioning and discourse analysis. In practice, the most traditional methods of collecting data for this type of study are individual interviews or focus groups. With Reach your Market, we also use an innovative data collection method: online user communities, through our yoomaneo platform. In addition to offering the flexibility of digital data collection, the interest of this solution is to mix individual and collective data collection techniques by offering the possibility for users to express themselves individually and then interact with the other participants.It is this double approach that allows us to collect particularly rich and unbiased data.

When conducting quantitative studies, the objective is to measure and quantify the opinions of users auprès d’un large panel de participants, représentatif de la cible visée. Grâce aux analyses statistiques, les études quantitatives permettent de mesurer plus finement certains points, de modéliser des données, de confirmer les résultats d’une étude qualitative préalable ou de déterminer quelles sont et comment se forment les préférences des utilisateurs. En pratique, les questionnaires en ligne sont le mode de collecte le plus adapté puisqu’ils permettent de poser rapidement un certain nombre de questions fermées ou à choix multiples et qu’ils peuvent être complétés par les utilisateurs à tout moment.

Le tableau comparatif ci-dessous reprend les grandes différences (en termes de méthodologie et de résultats) entre les études qualitatives et les études quantitatives proposées dans notre service Reach your Market.

Our models for rapid and robust usage studies

- "First Exploration", a qualitative study model that allows to explore the spontaneous interest for your innovative product or service among our user communities and understand the motivations and obstacles of your targets as well as the conditions for the success of your innovation. Thanks to this study model, you will obtain in a few days a deliverable of results with operational recommendations for the continuation of your project.

- "Usage Check", another qualitative study model that allows to evaluate the acceptability and desirability of your innovation among its targets (BtoB as well as BtoC) and also the different functions / characteristics of your innovation.. Within 4 to 6 weeks, you will receive a complete, interactive and turnkey deliverable as well as personalised recommendations on strategic and operational aspects to maximise your project's chances of success.

- "Quanti Validation", a quantitative study model that allows you to measure the opinions of your users and ensure that your innovation makes sense to a large panel of respondents. Within a few weeks, you will also obtain an interactive deliverable of results to guide you in the next steps of your project and in your decision making.